On... A Melting Ice Cube

Money is like a melting ice cube. Given enough time, it disappears.

People know inflation but my guess is they don't think about what that means and how it affects their life in the long run. A melting ice cube is a good way to look at it. Its because inflation erodes your net wealth over time.

Generally, I see people react to inflation in 2 ways (at the extreme end of the spectrum). First is the rich ones. They worked hard and saved a lot. So they think they have enough in the stock pile to support their life post retirement. The other end of the spectrum is the one who is poor and at this end, there is no more choice. The only option is to work until they die.

This time, I want to look at the first case - those who have money. The question is, how do they treat their money? Do they realize that money is a melting ice cube and if you don't do anything about it, it eventually disappears. If you invest your money (in any way, shape or form), then kudos to you. If you don't, then consider the following scenario.

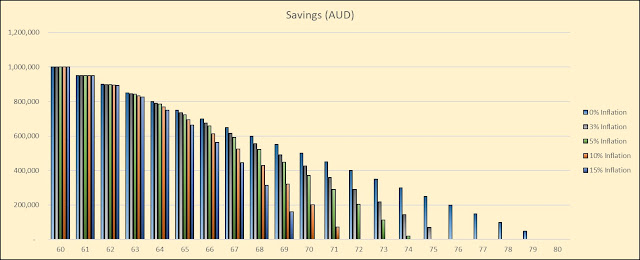

Say you saved a million dollars and is ready to retire. You make a quick calculation and find that you spend 50k a year. If you retire at 60, and you expect to live another 20 years, then you're all good?

Well no. Because that doesn't take inflation into account. Inflation melts your net wealth away. The chart below shows 5 cases. Inflation at 0%, 3%, 5%, 10% and 15%. In this way, 0% is an ice cube that never melts. 5% is an ice cube that is melting and 15% is an ice cube that is melting very fast. The chart shows that if you assume inflation at 0%, your savings take you to 80 years of age. If inflation does go all the way up to 15%, your savings will lasts you only until the age of 70!

Your money is like a melting ice cube. Do something - invest them and stop/slow them from melting!

Comments

Post a Comment