On.. Not all DCA are Created Equal

What do we do if we have a stack of cash to deploy? I believe that for an asset that is predicted to go up in the long term, Lump Sum is the way.

Having said that, and I do have a stack of cash sitting on the sidelines at the moment, I chose to DCA (Dollar Costs Average) instead. Mathematically speaking, I think Lump Sum gives a better financial return. But it is not all about the total returns. DCA means that I will a stack of cash available in case of an emergency. It is also more fun to deploy cash over time.

So DCA is better, that is settled then? It is in general but there are still some variations in how you can deploy your DCA. Although I prefer, DCA for the reasons stated above, I also like financial returns. Therein, I explore the different DCA scenarios. 1. DCA at the same rate over the investment term. 2. Front load your DCA. 3. Back load your DCA.

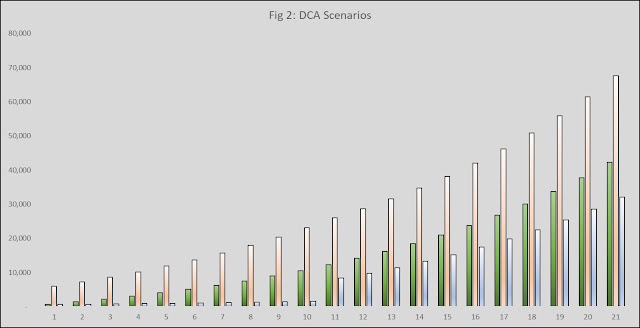

Figure 1 shows the DCA Scenarios. The assumption is that I have 12,000 AUD to deploy over a 20 year period with a return of 4% per annum. The first scenario (Green Bar) is an equal weighted DCA, which is the most commonly used. The second scenario (Peach Bar) is to front load the DCA, that is to start with a lump sum of 6,000 AUD and deploy the remaining over the next 10 years. The third scenario (Blue Bar) is to back load the DCA, that is to start with just 600 AUD and wait until year 11 before starting to deploy your stack.

As you can see, the front load scenario yields the best return. But to be honest, over a 20 year period, the difference is not great. Which means, it doesn't really matter how you DCA. Now, what if I increase the return to 10% per annum instead. As shown in Figure 2, the front load scenario starts to stand out!

Therefore, instead of an equal weighted DCA, I actually do a front load DCA to get a better return.

Comments

Post a Comment