On... 2024

2025 marks the starting of the eight year of my investing. 2024 is a bumper year for me (see below Figure). My Net Worth broke All Time High in 2024 with a growth of 45% (Largest growth so far).

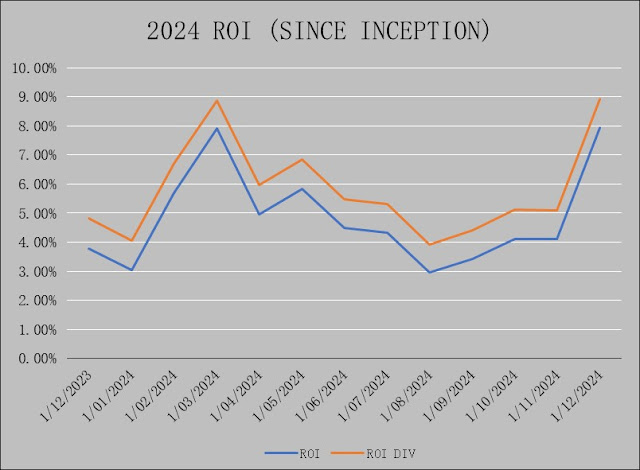

The earlier part was pretty good and trending upwards until circa April 2024. It then started to dump and luckily reversed in December. ROI for my Portfolio is 7.9% (ROI since Inception). For the latest Portfolio Updates, see Portfolio Updates.

In 2024, I started to include shorter term trades after listening to the 'Top Traders Unplugged' podcasts. They recommended diversifying across time frames to capture all possible upsides. The short term trades have a holding period of days to roughly a month.

This year (and consistent with the past few years), Buy and Hold largely outperforms short term and mid term trades. Does it mean that I should revert to Buy and Hold? I think probably not. It just means that the market structure favors Buy and Hold but we do not know how the structure will change going forward. It is important to maintain a Diversified approach.

The best performance in my Portfolio so far is BNB (+78% ROI since inception). BNB is a crypto currency that is tied to the Binance ecosystem. Binance as of the time of writing is still the largest Centralized cryptocurrency exchange with about 250 million users. BNB is my 6th largest position in terms of invested capital. As of now, I do not plan to change my allocation of BNB.

The worst performer in my Portfolio is EXL (-99% ROI since inception). It has been down for a long time and failed to rebound. It seemed that the cannabis space was a bubble and speculative hype after all.

What does my crystal ball tell me about 2025? Word on the street is that 2025 will be mega bullish for the crypto sector. BTC entered into its halving cycle in 2024 and the year after the halving usually has parabolic growth. On the other side, the stock market is feeling overvalued with only about 7 of the top stocks in the SnP500 carrying the weight of the whole American stock market (usually a bell weather for the global market).

2024 turned out to be a historical year for me as I finally reached Cashflow Positive after digging in the trenches for the past 7 years. Fingers crossed that this momentum persists, but I am expecting a pullback sometime, which may bring the 'business' back to Cashflow negative.

Comments

Post a Comment