On... 2023

2024 marks the seventh year of my investing. 2023 was the best year for me (see below Figure). Ironically my trading is down for the year but my Portfolio growth has been the best since inception (although still far from Portfolio All Time High).

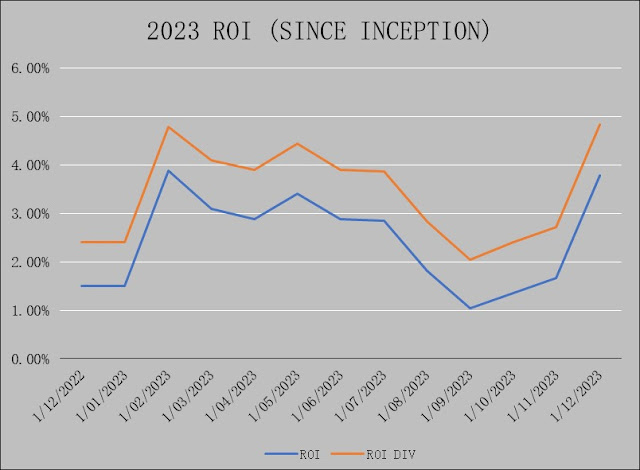

The earlier part was rangebound and mostly trending downwards until circa November 2023. It then went on a tear and almost reached the ASX200 ATH of 7632 points. ROI for my Portfolio is 2.7% (ROI since Inception). For the latest Portfolio Updates, see Portfolio Updates.

There is no big changes in my trading/investing in 2023. As mentioned above, 2023 turned out to be the best year for me (Absolute Values). This is in contrast to losing money in my Active trades. It is counter-intuitive at first glance but think of the following scenario.

You could run a business selling goods for example and due to poor demand in the year, you could suffer a loss. At the same time, the shop that you own that sits as an Asset in your Balance Sheet could have increased significantly in the same year. In my case, I suffered a large drop to my Portfolio in 2022. And in 2023, my Portfolio value started at a low base. Although my Active trades suffered a loss in 2023, my long term holdings have increased significantly (especially in the crypto space)... i.e Bitcoin went up 170% in 2023.

The best performance in my Portfolio so far is WBT (+102% ROI since inception). WBT is a technology company developing non volatile memory using Resistive REM technology. AI has been on a tear in 2023 and technology companies may have benefitted from that.

The worst performer in my Portfolio is EXL (-99% ROI since inception). It has been down for a long time and failed to rebound. It seemed that the cannabis space was a bubble and speculative hype after all.

What does my crystal ball tell me about 2024? Word on the street is that 2024 will be mega bullish, especially for the crypto sector. BTC will be entering its halving cycle, estimated to be April 2024. Analysts are also forecasting positive Macro framework from interest cuts as inflation has been coming down in 2023. 2024 also coincides with the American election cycle.

With all the expected Bullish setup, it is my hope that my Portfolio will return to All Time High by the end of 2024.

Comments

Post a Comment