On... 2020

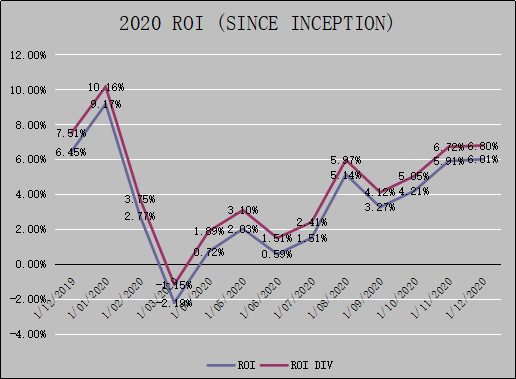

The bad news is I am not able to beat the market in 2020 (ROI since inception ASX200: +8.52%, Me: +6.8%). The good news is my return is positive this year, which is good because making money is more important than beating the market. For the latest portfolio update, see Portfolio Update.

This year has been very tough for investing and trading due to the Covid 19 pandemic. The market crashed in February but rebounded strongly at the end of March. I was lucky to go to mostly cash when the sell-off started but found it hard to re-enter the market. I can still remember the fear of investing at that time. I truly thought that my investment (about 30% invested, 70% cash) would go to zero. The fear is real. I started to re-enter the market slowly in April but the market was too volatile and my stocks kept getting stopped out. My performance started to pick up only in the last quarter of 2020.

The best performing stock (ROI since inception) of the year was WBT, +70.9%. This is a stock that was once among the worst performer - sometimes Buy and Hold works and stocks do turn around. I am happy that I held it through the drawdown. The worst performing stock is EXL, -84.4%. This was also the worst performing stock last year, and I'm starting to feel that it will never turn around. But I'm still hoping with a new CEO (appointed in April 2020), there might be a miracle.

This concludes my third year of investing and I don't plan to make any changes to my process and strategy going forward. Have I learned anything this year? I learned that fear is real and to buy when everyone is selling, is almost impossible. If there is another crash in the future would I be able to buy when everyone is selling? I highly doubt so. No doubt those who bought in March had done very well.

What about 2021? My crystal ball tells me the market will probably end lower. It seems like all the positive news have been priced in and everyone is expecting the economy to recover once the vaccine is rolled out. 2021 might also see a pick up in inflation (due to the money printing ), and this bodes well for commodity and energy stocks. I have been picking up stocks in the Basic Materials and Energy sectors recently and will continue to seek opportunities in these sectors in the near term.

Comments

Post a Comment