On... the Fear of Negatives

I shared my Quarterly Performance with a friend recently and he came back with the response “Why are there so many negatives?”. That may be a polite way of saying - your result is quite poor. Its definitely better to have all positive returns and no negatives, but in the stock market, not only is that near impossible but it might not actually matter too much.

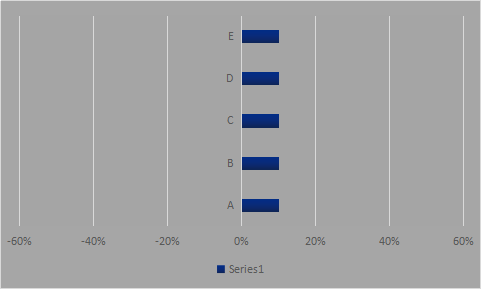

If (and that’s a big IF), you had good portfolio/capital allocation, the negative return on single stocks don’t really matter much. Lets have a look at 3 hypothetical scenarios. Each scenario has a total investment of $100 split over 5 stocks - A, B, C, D and E, with different P/L (profit/loss) and portfolio allocation.

Scenario 1 - each stock in the portfolio has a 10% return

Scenario 3 - stock A has negative 30% returns but the rest have 50% returns

Which scenario as an investor would you like your portfolio to look like? If you had chosen Scenario 1 or Scenario 3, then choose again. The best portfolio is actually Scenario 2, which has a lot of negatives. Is this a trick question? Yes, it is! Because there is a very important piece of missing information - Capital Allocation.

With this added information, let us calculate the Net Asset Value (NAV).

Scenario 1 NAV = (20*1.1 + 20*1.1 + 20*1.1 + 20*1.1 + 20*1.1) = $110

Scenario 2 NAV = (80*1.3 + 5*0.5 + 5*0.5 + 5*0.5 + 5*0.5) = $114

Scenario 3 NAV = (80*0.7 + 5*1.5 + 5*1.5 + 5*1.5 + 5*1.5) = $86

Turns out the scenario with lots of negatives came back with the best result. The fear of negatives keeps people away from the stock market and to observe from the sidelines. Don’t fear negatives, fear losing money. Fortunately, in the stock market, you can have (a lot of) negatives and still have the possibility of not losing money.

Comments

Post a Comment