On… the Road to a Million

Last blog, I was sharing about the amount of passive income generating Asset I require to retire comfortably (in 20 years’ time), which is a million dollars. Now the question is, how are we going to get there? Lets explore the options (These options are of course not holistic, as they say there are more than 1 way to skin a cat).

Option 1 - SAVE. If we can save 42,00$ every month. It will be 50,400$ of savings per year and 1,008,000$ in 20 years. That’s easy if we earn a combined income of 42,000$ every month and we just have to save 10 percent of that income. Unfortunately, we don’t earn that kind of money.

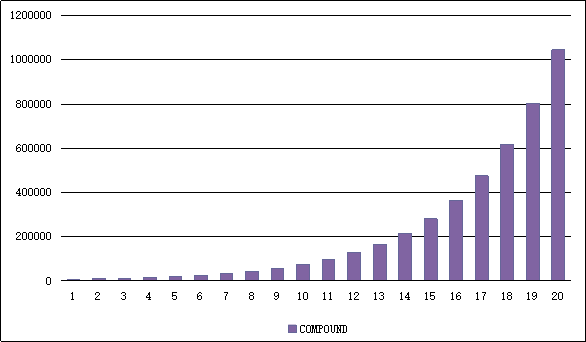

Option 2 – COMPOUND. Mr Warren Buffett compounds his investment at roughly 30% annually. If we can compound like Buffett, we would just need a modest starting capital of 5,500$ and with a CAGR (Compound Annual Growth Rate) of 30%, we will hit 1,045,273$ in 20 years’ time. That’s sweet, unfortunately we’re not Buffett and will not even come close to his performance of a 30% CAGR.

Option 3 – SAVE & COMPOUND. If we can save some money every month and compound that saving at a reasonable rate, we should be able to make a million in 20 years’ time. The CAGR that we would be targeting for would be 10%. That should be achievable with a bit of luck. We also compute a low case of 7% CAGR and a high case of 15%. A CAGR of 7% would take 23 years to reach a million dollars and a CAGR of 15% would take just 17 years.

So, there you have it - the road to a million all mapped out. There are of course different kinds of investment vehicle that we can use for this journey. Some would invest in property. Some would start a business. Some would buy lottery. Some would buy bitcoin… etc. For me? I believe that the best investment vehicle to achieve our target would be through equity investments. Of course, I could change my mind tomorrow or the week after. Strong Beliefs, Loosely Held.

Comments

Post a Comment