On... 2020

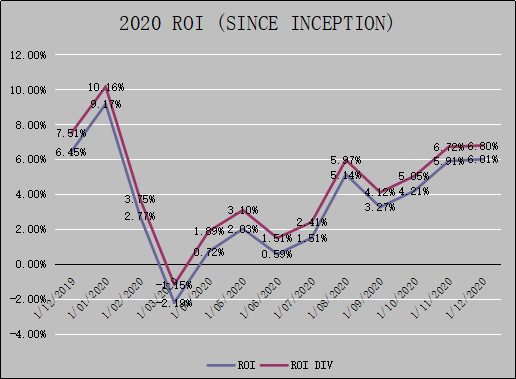

The bad news is I am not able to beat the market in 2020 ( ROI since inception ASX200: +8.52%, Me: +6.8% ). The good news is my return is positive this year, which is good because making money is more important than beating the market. For the latest portfolio update, see Portfolio Update . This year has been very tough for investing and trading due to the Covid 19 pandemic. The market crashed in February but rebounded strongly at the end of March. I was lucky to go to mostly cash when the sell-off started but found it hard to re-enter the market. I can still remember the fear of investing at that time. I truly thought that my investment ( about 30% invested, 70% cash ) would go to zero. The fear is real. I started to re-enter the market slowly in April but the market was too volatile and my stocks kept getting stopped out. My performance started to pick up only in the last quarter of 2020. The best performing stock ( ROI since inception ) of the year was WBT, +70.9%. This is a stock t...